GradGuard’s tuition insurance is the first program to offer nationwide protection for epidemics, including getting sick with COVID-19 – providing a financial safety net when schools don’t

PHOENIX, April 8, 2022 /PRNewswire/ — GradGuard, the nation’s leading authority on helping protect college students and their families from the risks of college life is pleased to announce the addition of an epidemic coverage endorsement on new tuition insurance plans.

Tuition insurance can provide reimbursement for a complete medical withdrawal due to a covered illness or injury, including mental health conditions and death of a student or tuition payer.

The epidemic coverage endorsement can provide protection for when an insured student completely withdraws from school for the covered term due to becoming ill with any epidemic or pandemic disease, including COVID-19. GradGuard tuition insurance plans purchased on or after February 18, 2022 include the endorsement.

"This new epidemic endorsement shows our dedication to the wellbeing of college students and their families’ investment in higher education," said John Fees, co-founder of GradGuard. "We worked with our partners at Allianz Global Assistance to include this coverage to protect students from the risks associated with Covid-19."

"We’re proud to partner with GradGuard to provide epidemic coverage to college students and their families," said Robert Cavaliere, Chief Sales Officer at Allianz Partners USA. "The addition of this important layer of protection in our tuition insurance products is especially timely gien the concern over COVID-19 at college campuses."

Claims due to known, foreseeable, or expected events, epidemics, cessation of operations by the school, or fear of attending school are generally not covered. GradGuard’s industry-leading tuition insurance program has been adopted by more than 250 institutions nationwide, demonstrating the real need for modern forms of financial protection.

GradGuard’s tuition insurance can provide affordable protection that includes up to 100% of the cost of college including student housing, tuition and academic charges. In addition, each policy also includes Student Life Assistance that helps families through the logistics that may accompany an unexpected student withdrawal.

"Making the decision to withdraw from college is never easy," said Fees. "GradGuard’s tuition insurance can help reduce the financial stress students and families face in these situations and help everyone focus on the well-being of the student."

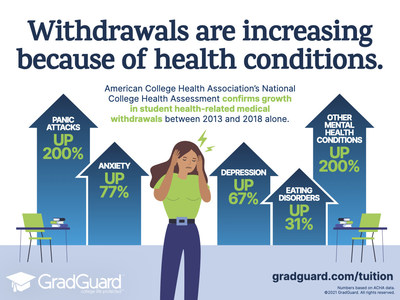

It’s important for families to note that even prior to COVID-19, student health conditions force thousands of students to withdraw from classes each year, without the ability to recover the thousands of dollars paid for classes, fees and housing.

34% of college students have anxiety, and those rates have risen in recent years, according to data from a 2021 Healthy Minds Network Study. Nearly 73% of students reported moderate or serious psychological distress in the Fall 2021 American College Health Association National College Health Assessment survey.

The Top Three Reasons GradGuard’s Tuition Insurance Is A Smart Decision:

- If the school does not provide a 100% refund – Ask your school about their refund policy.

- If the student has more than $1,000 of academic expenses – Even if the school provides a 100% refund for tuition, most do not refund academic fees or student housing costs.

- If the student or family is taking out a student loan – Student and parent loans must be repaid even if a student must take a medical withdrawal. Tuition insurance can be used to repay the balance of these loans.

GradGuard’s tuition insurance can help reduce the stress students face in situations when they consider a medical withdrawal. Tuition insurance can reimburse the out of pocket costs associated with a student’s housing, tuition, and student fees which helps everyone focus on the well-being of the student. Students with pre-existing conditions can also be protected if they are medically cleared to attend school at the time they purchase their plan.

Additionally, each policy includes Student Life Assistance, that can help families through the logistics that may accompany an unexpected student withdrawal with the following:

- Family Travel Assistance: In the event that the insured student becomes ill or injured requiring hospitalization during the covered term, we can assist in making travel arrangements for you to visit the hospital where the insured student is admitted.

- Getting the insured student home after medical care: if an insured student becomes ill during the covered term and requires transportation to a facility of higher level of care or home, we can arrange for transport to a location or medical facility of their choice. We can also arrange for transportation to include a medical escort if necessary.

- Vehicle Return: if the insured student can’t drive home because of illness/injury, we can arrange to have the insured student’s car driven to his or her U.S. place of residence. Please note, the above are assistance services only, not financial benefits. The recipient of the services is fully and solely responsible for all charges by vendors for services provided. All terms, conditions, and exclusions of the plan apply.

"Students and their families can take confidence in schools that provide GradGuard’s insurance programs to help protect their investment in college and are prepared to overcome the unexpected events that may otherwise disrupt their semester," said Fees.

For tuition insurance plans purchased before February 18, 2022 that do not include the Epidemic Coverage Endorsement, GradGuard and Allianz Global Assistance are currently accommodating claims for when an insured student completely withdraws from school for the covered term due to becoming ill with COVID-19. This accommodation is strictly applicable to COVID-19. All other terms, conditions, and exclusions of the plan apply as normal.

About GradGuard: GradGuard is the nation’s leading provider of college renters and tuition insurance. GradGuard is trusted by more than 450 colleges and universities to educate and protect nearly one million students and families. Visit GradGuard.com to use its college insurance search tool to find the insurance programs that are right for your college student or recommended by their college or university.

Contact:

Natalie Tarangioli

GradGuard

650-302-5656

[email protected]

Tuition insurance plans have terms, conditions, maximum benefit limits and exclusions which apply. Plans only available to U.S. residents and may not be available in all jurisdictions. Plan terms and coverage and limits vary by plan purchased and by state. GradGuard is a service of Next Generation Insurance Group, LLC, the licensed agent for all tuition insurance plans. Plans include insurance benefits and assistance services. Insurance benefits are underwritten by Jefferson Insurance Company. Non-insurance benefits/services are provided and serviced by Allianz Global Assistance. Claims are administered by Allianz Global Assistance. Allianz Global Assistance and Allianz Tuition Insurance are marks of AGA Service Company d/b/a Allianz Global Assistance or its affiliates. AGA Service Company and Next Generation Insurance Group, LLC are affiliates of Jefferson Insurance Company. The insured shall not receive any special benefit or advantage because of AGA Service Company’s or Next Generation Insurance Group, LLC’s affiliation with Jefferson Insurance Company. Except as expressly provided under the plan, consumer is responsible for charges incurred from outside vendors for assistance or concierge services. Contact Allianz Global Assistance at 888-427-5045 or 9950 Mayland Drive, Richmond, VA 23233 or

333746@email4pr.com

.

SOURCE GradGuard